This is a comprehensive and insightful look into the NBA’s claims of financial distress from Nate Silver:

This is a comprehensive and insightful look into the NBA’s claims of financial distress from Nate Silver:

As the NBA prepares to battle the player’s union over revenue, the league has made several public claims about how they have been losing money for years.

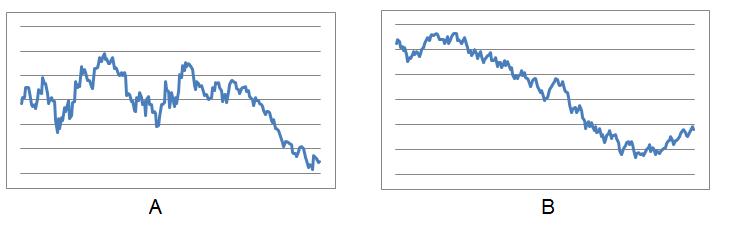

Silver takes a deep look into those claims. He crunches the numbers and compares player revenue as a share of league revenue across the four major sports leagues; he looks at salary growth relative to league growth; and he also discusses some of the dubious accounting tricks teams and leagues use to make profits disappear!

As usual from Nate Silver, this is a very interesting and readable application of mathematics and statistics. His conclusion is summed up best by a recent message from @fivethirtyeight on Twitter: “If David Stern really thinks the NBA lost $370 million last season, shouldn’t he have fired himself?”